Archive for June, 2014

Shaving $AET down to size

Posted by stubbybrown in ATH, Case Studies on 2014/06/29

Name: Aetna Inc

Sector/Industry: Healthcare/ Healthcare Plans

Thesis: a long track record of solid fundamentals and accretive acquisitions has set Aetna up to be one of if not the top health insurance provider in the U.S. Top dividend grower.

Next earnings date: ~ July 29, 2014 before market opens

Risk: Medium to low: PE 14.4, forward PE 11.39, PEG 1.49

Portfolio status/Position: Core/Entry position

Last trades: Jun-26-sell @ 81.55, Jun-26-sell @ 81.31, Jun-27-sell @ 81.16, Jun-27-sell @ 81.25

Barchat.com Alpha Weighted Index: 33.20

Technical trading their: Middle

Chart Analysis: Over the last few days I have shaved down my position in AET from full position to entry level. In tandem with the S&P 500, AET has made new all-time highs while reverting to the mean. The chart below shows price levels I sold chucks of stock. Chart also shows the supporting trend line AET has fallen back to. My Price target is $85 – $87 based on analysts projections. Given the run steep slope of trajectory, I will buy & sell opportunistically but will not grow the position back to full size until more significant correction and mean reversion from the down side.

Other names I currently own are: $GTAT $AKRX $PPC TRN $MPAA $ITMN $LNC $OXY

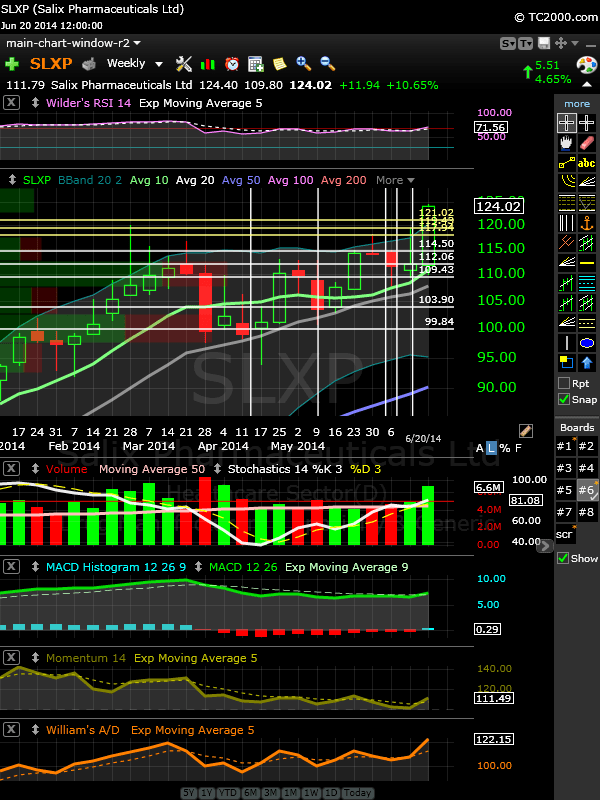

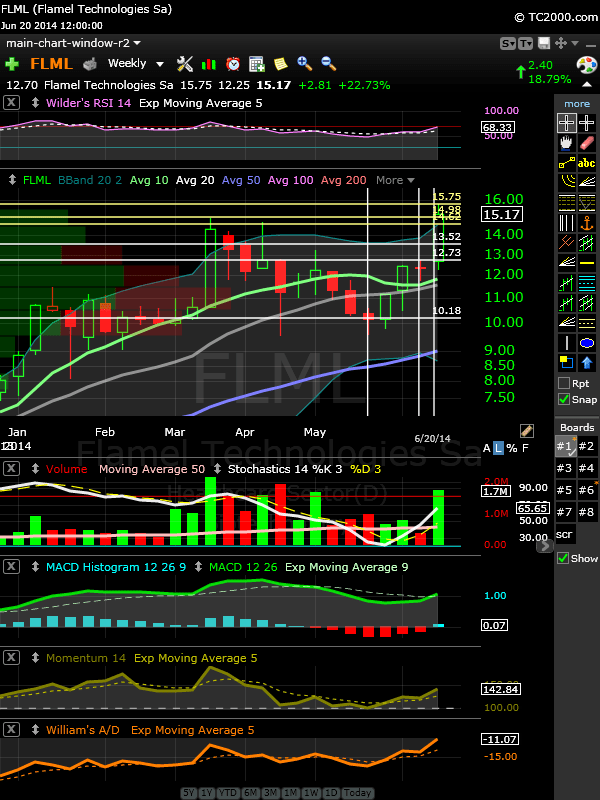

20140622 $SXLP $FLML chart analysis very similar to my recent post on $NXPI

Posted by stubbybrown in Case Studies on 2014/06/22

$SLXP and $FLML are 2 more names that populated my top long watch list on last Friday and are very similar chart-wise in my recent discussion with $NXPI. Bottom line is I’m bullish these names but watch over the next week and look for weakness as potential entry or add points. Watch their hourly behavior around the yellow lines of support.

Name: Salix Pharmaceuticals Ltd.

Symbol: SLXP – quote provided by Finviz.com

Location: Raleigh NC, U.S.A.

Sector/Industry: Healthcare/Generic drugs

Barchart.com Weighted Alpha Index Value: 90.36

Name: Flamel Technologies SA

Symbol: FLML – quote provided by Finviz.com

Location: France

Sector/Industry: Healthcare/Drug delivery

Barchart.com Weighted Alpha Index Value: 121.71

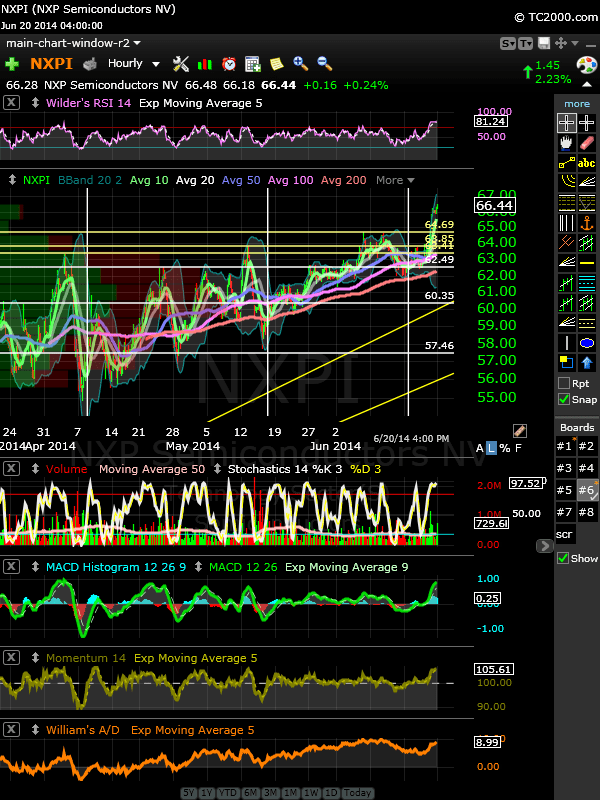

20140622 $NXPI – A technical case study and swing trade analysis

Posted by stubbybrown in Case Studies on 2014/06/22

Name: NXP Semiconductors NV

Symbol: NXPI – quote provided by Finviz

Location: Netherlands

Sector/Industry: Technology/General semiconductors

Barchart.com Weighted Alpha Index Value: 111.71

End of day Friday, June 20, 2014, my scans picked up a significant number of names (triggering bullish technical signals I watch for a regular basis) $NXPI being one of them. I’ll review my scanning techniques in another post, but this name triggered the following daily signals: daily STOCH Xup 80, vol > 50D ma, new 52 week high, new all time high. The following weekly signals were triggered as well: MACD signal Xup and Momemtum 14 Xup 5D ma. Not precisely sure when last week the weekly signals occurred. One of the tougher things about weekly signals but they are important too and not to be ignored nonetheless. More on that below.

Before I get too interested in a name just because it makes my scan and list inclusion criteria, there’s a number of things I do by looking at the chart to determine if this name is something worth paying more attention. In addition, I instituted a rule I follow which is to never to buy a name the following day I allow a name to jump on my top long watch list. I’ve gotten burned too many times buying right out of the gate. My general practice of swing trading is to buy or add on temporary short-term weakness, not strength.

In a nutshell, these are the steps I take before I populate a name on my top long watch list:

(1) Establish trend lines on the hourly, daily and weekly candle bar charts. Sometime I look at the 5 min and monthly charts.

(2) Look for and note near by support & resistance price points on the chart with yellow horizon lines.

(3) study the MACD & STOCHs first and note a pattern of oscillation with the MACD histogram study. I use Worden TC2000 for these studies are readily available. Valid MACD Xups are followed up or preceded by STOCH Xups in the same time frame. If a Xup is confirmed, I insert a white horizontal line at the close of the candle in that time frame.

(4) Then I watch for while and anticipate characteristic trending patterns based on the frequency of Xups I observed above.

(5) Only if the name meets the criteria to be included in my top watch list (another post), I’ll include it in the appropriate list.

(6) Some names trade with somewhat predictable regularity and if the pattern suites me, I may still follow the name and could decide to begin to accumulate shares at a future point of opportunity.

After doing the first 3 steps anyway, I came up with the following hourly candle bar chart:

The yellow horizontal lines are lines of support based on recent tops. Eventually $NXPI will pull back. Depending on when, these lines will be first line of support before the name breaks down below the top most white horizontal line when the last MACD Xup occurred in this time frame.

The weekly chart is interesting too. See below. Remember I noted $NXPI triggered it’s weekly MACD Xup signal and Momemtum 14 5D ma signal. Weekly Bollinger bands have tightened and the last weekly bar crossed up through the top BB, yet another bullish signal. So this name should be watched and is a prime candidate for entry on the next dip.

20140621 $OXY weekly wrap

Posted by stubbybrown in 52 week highs, ATH, Portfolio on 2014/06/21

Name: Occidental Petroleum Corp

Sector/Industry: Energy/Oil & Gas Exploration & Production

Thesis: $OXY beat last earnings estimates by $0.05 on May 5, 2014. Spinning off California assets into independent E&P seen favorable by the market sheading focus on parent company global backlog, increasing earnings growth and steadily growing dividend.

Next earning date: 7/30/14 *Est.

Risk: Low with P/E 1/2 of sector peers.

Portfolio status: Bedrock/Anchor. Level of investment is full. Buying strategically only on dips more than 5% below most recent 52 week high.

Last trades: On 20140617 buy @ 102.35, on 20140613 buy @ 101.93.

All time high/52 week high: $117.89 May of 2011 /$104.14 on June 21, 2014

Price target: $115

Technical trading tier: Lowest

Chart Analysis: Weekly chart below shows $OXY is just about reached a level of resistance drawn at 104.36. Levels are based on prices going back a ways based on much different boundary conditions on the economy. Levels should be taken with a grain of salt. So this is trading approach I’m implementing. Watch the hourly charts and in particular when MACD Xup it’s signal. If stochastics Xup 80, consider that a signal to buy if stochastics Xdown 80 for a short period time and Xup 80 very soon after. Look for daily MACD Xup, daily stochastic Xup for confirmation.